OrcaTrade - Algorithmic Trading Orchestration Agent Platform

A high-performance web platform that empowers quantitative traders and hedge funds to build, backtest, deploy, and autonomously orchestrate sophisticated algorithmic trading strategies using AI agents. OrcaTrade combines a sleek, real-time interface with a robust autonomous agent framework that continuously monitors markets, adapts strategies, and executes trades while strictly respecting user-defined risk boundaries.

How It Works:

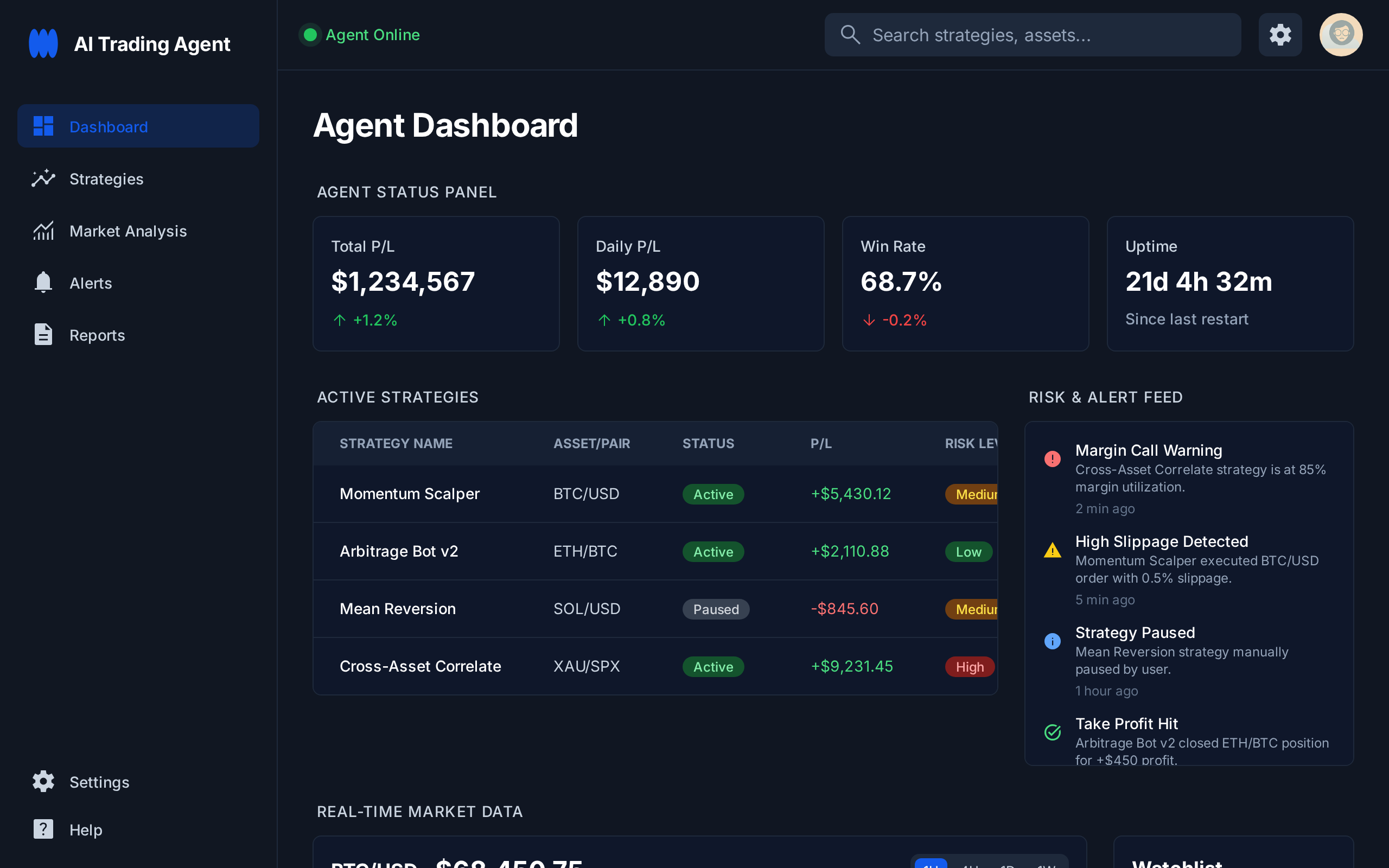

1. Real-Time Dashboard - Instant overview of all active agents, live P&L, exposure, drawdown, risk alerts, and streaming market data feeds. Critical events trigger immediate visual and sound notifications.

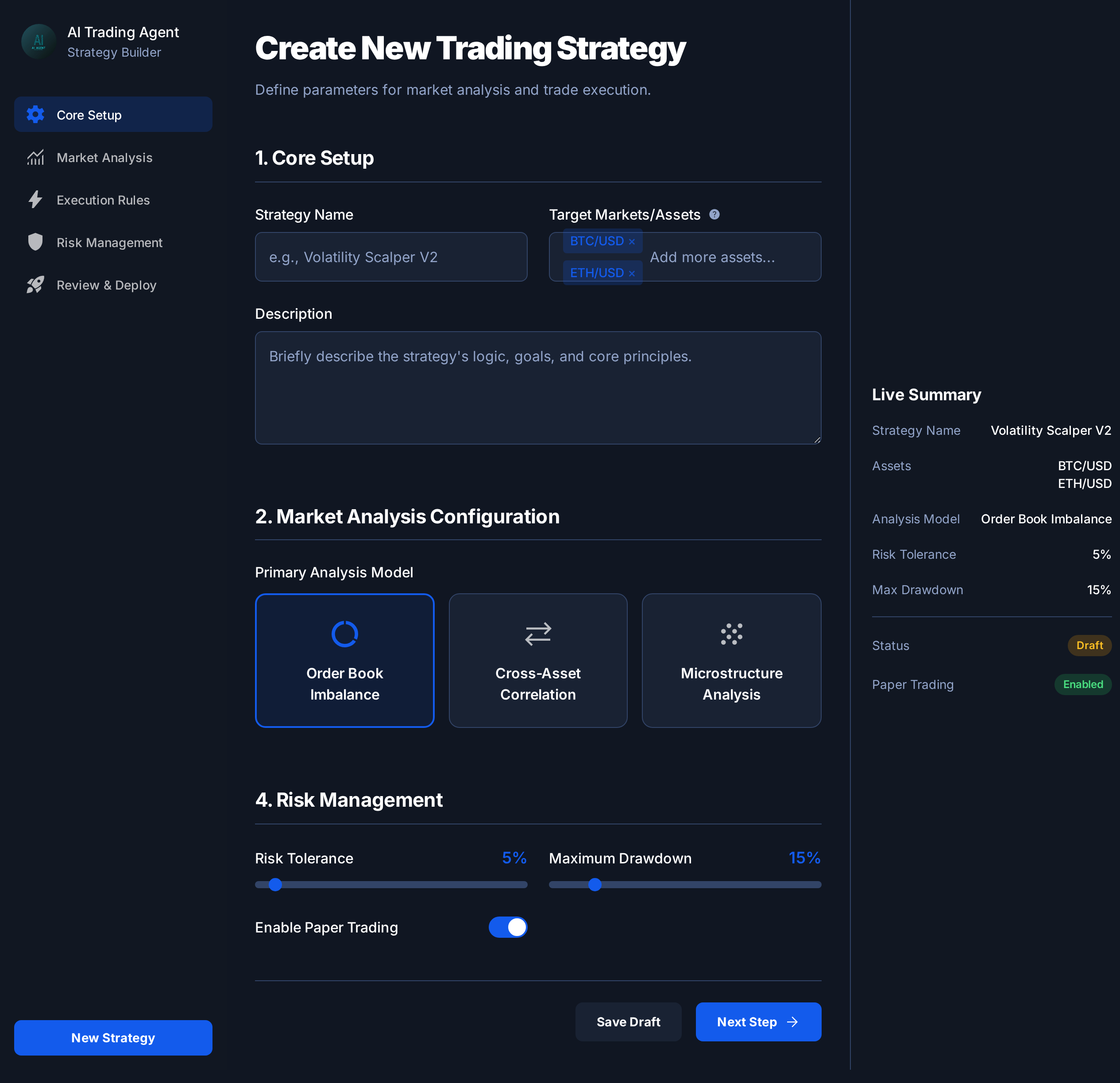

2. Strategy Development Studio - No-code/low-code builder + Python editor to design new strategies. Users define market analysis logic, signal generation, execution algorithms, and agent behavior using modular components and custom scripts.

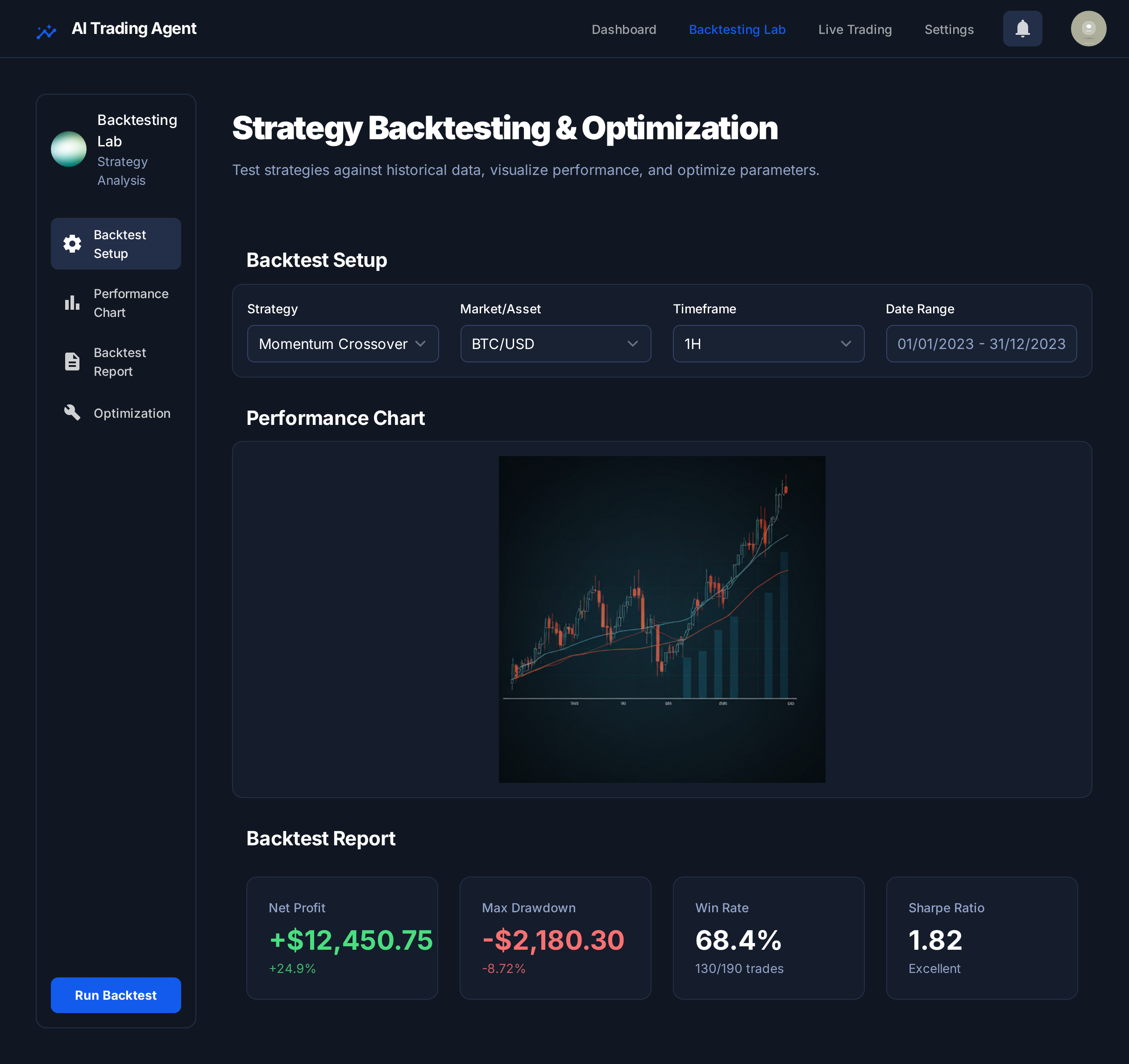

3. Advanced Backtesting & Optimization - GPU-accelerated historical simulation engine with walk-forward analysis, Monte Carlo simulations, slippage modeling, and hyperparameter optimization powered by Optuna and Ray Tune.

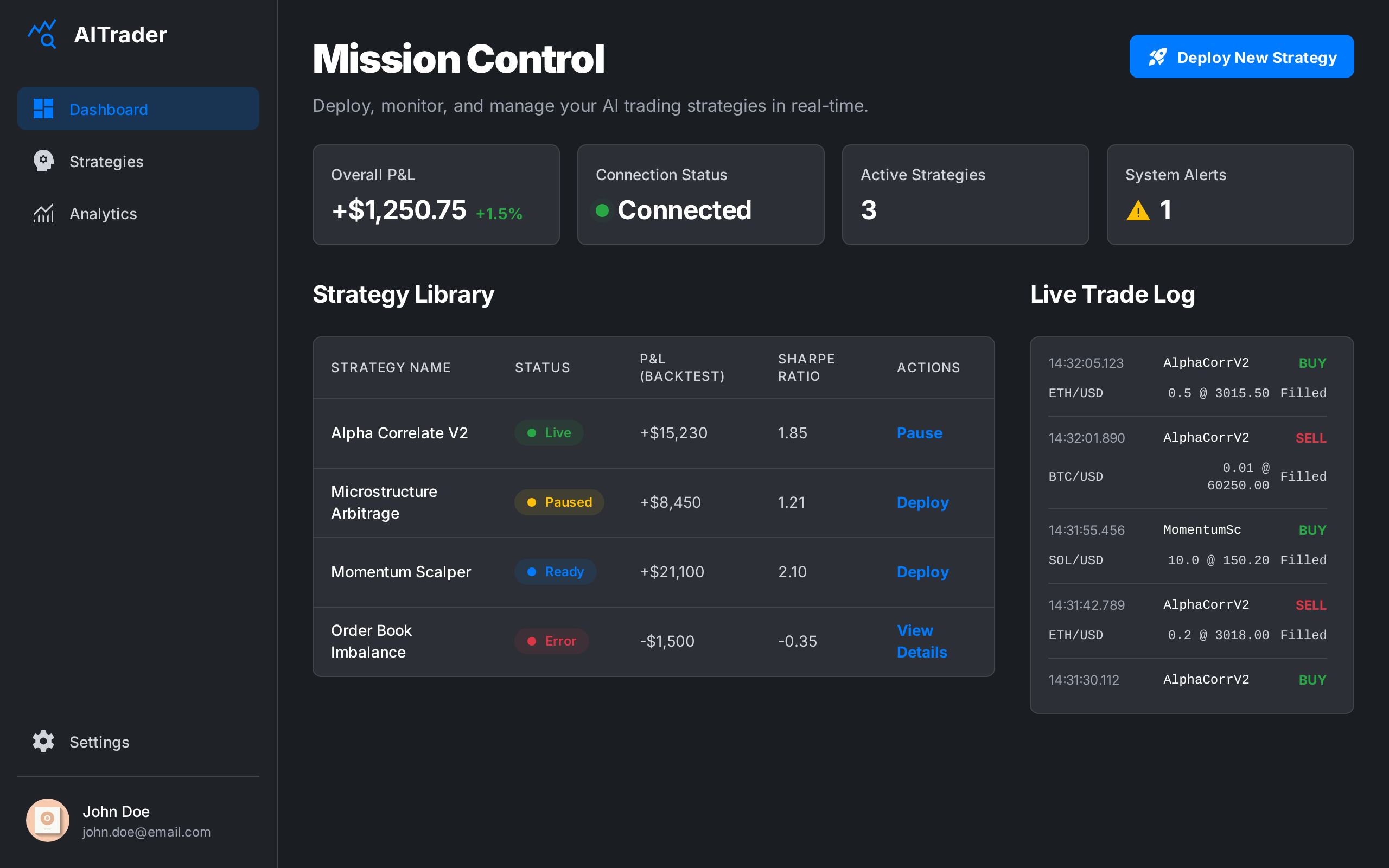

4. Live Deployment & Autonomous Orchestration - One-click deployment turns strategies into autonomous AI agents running in isolated containers. Agents continuously re-evaluate market regime, self-optimize parameters within allowed bounds, and coordinate with other strategies to maintain portfolio constraints.

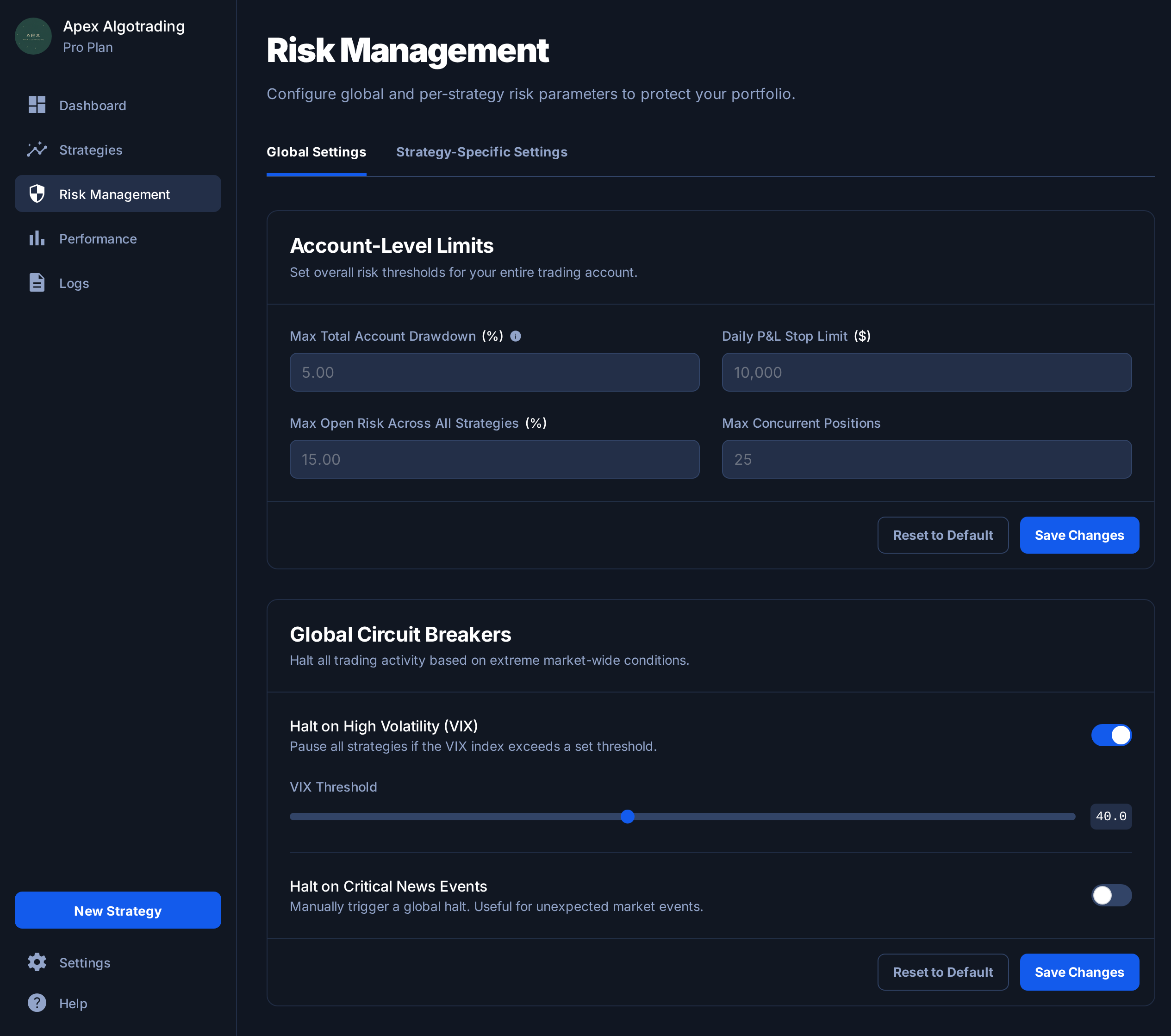

5. Enterprise-Grade Risk Management - Global and per-strategy risk controls: max drawdown limits, volatility targeting, position sizing (Kelly, volatility parity), dynamic leverage, circuit breakers, and kill switches. Real-time VaR, CVaR, and stress testing.

6. Deep Market Intelligence - Live order book heatmaps, volume profile analysis, cross-asset correlation matrices, microstructure analytics, and AI-generated insights to refine strategy logic.

Technical Stack: Frontend (SvelteKit, TypeScript, Tailwind CSS, Chart.js, Lightweight Charts by TradingView, WebSocket streaming), Backend (Flask + Flask-SocketIO, Python 3.12, async support via gevent), AI/Agent Framework (LangChain, LangGraph, CrewAI patterns), Data & Execution (PostgreSQL + TimescaleDB, Redis Streams, Apache Kafka for market data, broker APIs: Alpaca, Interactive Brokers, Binance, Bybit), Infrastructure (Docker, Kubernetes, Helm, Prometheus + Grafana, Loki logging, Terraform).

Project Details

Client

Hedge Funds & Professional Traders

Industry

Algorithmic Trading Platform

Date

11/22/2025

Tech Stack